Over time, there were defined clear rules for each pattern, and that is how graphical analysis appeared. Common chart patterns are used for forecasting in Forex like they were used earlier, along with support and resistance levels. In my onion, patterns are the most accurate tool of graphical analysis. You only need to discover price patterns in the chart, and, if it works out, enter a trade and enjoy your profit. Next, we will deal with the three most common Forex chart patterns that will never lose their relevance and will suit both beginners and advanced traders. First of all, Forex charts are an essential tool for traders as they help visualize and analyze the fluctuations of currency exchange rates in real time.

- Rectangle, Trend line, Channel, pennant, flag, triangle, rising and falling wedge, head and shoulder are the most used forex chart patterns by professional traders world wide.

- Chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market.

- When the price breakout below the trendline and the Moving Average, the continuation signal is usually given.

- I will also share my experience and my own original Forex candlestick chart patterns, which I’ve been using for many years.

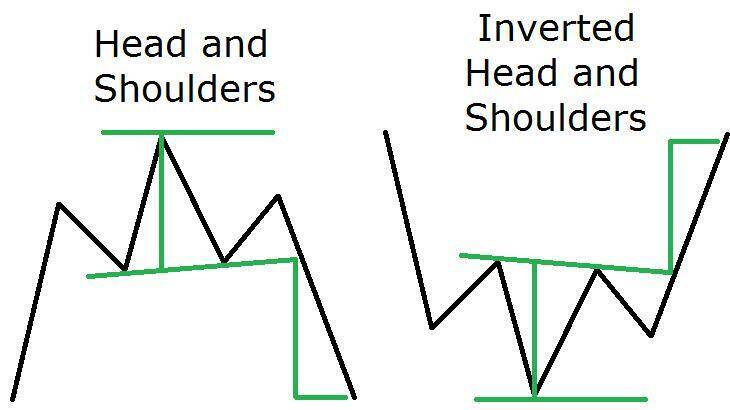

The pattern looks like a candle with a very small body and very long tails (wicks). Therefore, by the time of candlestick closing, the market hasn’t yet determined the new ongoing trend, as the demand and the supply are almost equal. However, the balance can’t last for a long time, and either buyers or sellers finally win, driving the price in the corresponding direction. The price should soon break through the low or the high of the volume candlestick, sending us a signal to enter a trade and work out the pattern. The first is a direct Head and Shoulders pattern where the head is the head and shoulders top (red), it looks like a double top formation.

Flat Breakout pattern

The most common reversal chart patterns include straight and reverse head and shoulders, double tops and double bottoms, falling and rising wedges, as well as triple tops and triple bottoms. Reversal chart patterns happen after extended trending periods and signal price exhaustion and loss of momentum. A Forex or Crypto chart pattern cheat sheet can help traders analyze market price movements and make informed trading decisions. By providing a comprehensive https://traderoom.info/how-to-exponential-function-in-python-code-example/ overview of the most common chart patterns, traders can improve their ability to identify key trends, resistance levels, and potential entry and exit points. Chart patterns are specific price formations on a chart that predict future price movements. Therefore, chart pattners are grouped into (1) continuation patterns – that signal a continuation in the underlying trend, and (2) reversal patterns – that signal reversal of the underlying trend.

This confirms that the buyers are buying the dips earlier each time and the sellers are not interested in getting engaged. In conclusion, I’d like to note that all price charts of technical analysis in Forex market are not rigid laws and can be interpreted in different ways. However, the longer is the timeframe, where you are looking for a scheme, the more likely is the way to work out. The trading strategy is based on the idea that there are two types of price gaps in the modern market. The first one usually happens when there is a break in trading on an exchange; the second one results from fundamental factors, affecting the market. This methodology suggests exploiting the second type of gaps, that is, the gaps emerging during trading sessions.

Bearish Continuation Patterns

Conversely, profits can be reaped if the trader remains composed and waits for the breakout. These indications imply that sellers have gained dominance in the market, causing prices to drop. So if you enjoy trading technical patterns, as I do, be sure to give some consideration to the three we just covered; they truly are all you need to become consistently profitable. The first is perhaps the most obvious – never cut off the highs or lows in order to make the channel fit.

Which chart pattern is more accurate?

Research shows the most reliable and profitable chart patterns are the Head & Shoulders, with an 89% success rate, the Double Bottom (88%), and the Triple Bottom and Descending Triangle (87%). The most profitable chart pattern is the Rectangle Top, with a 51% average profit.

Our pattern recognition scanner helps identify chart patterns automatically, saving you time and effort. The pattern recognition software collates data from over 120 of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. Alternatively, see a list of well-known and effective stock screeners here. The head and shoulders pattern tries to predict a bull to bear market reversal. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction.

Most efficient Forex patterns: a complete guide

If the market is inside the pattern, you can take short term trades, if the pattern shape got broken, then you can place a long term trades to catch big profits. For low risk, high reward trading opportunity, the starting point of the price move and the price direction should be predicted using the trends and the necessary chart formation. The stop loss order should be smaller and tight to avoid excess loss in trading.

Understanding Technical Indicators: Tools for Analyzing Market Trends – Business Post Nigeria

Understanding Technical Indicators: Tools for Analyzing Market Trends.

Posted: Wed, 14 Jun 2023 03:39:24 GMT [source]

During an uptrend, it is advised to place entry orders right above the high currency pair price, and during a downtrend, it is best to pace exit orders right below the low currency pair price. These patterns also signal trend reversals that again help traders to enter or exit the market accordingly. The butterfly chart pattern helps traders identify market reversals well before time. This leads to the traders making significant trade decisions with respect to the entry and exit prices.

Head and shoulders

The flag stock chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. Stock chart patterns are an important trading tool that should be utilised as part of your technical analysis strategy. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements.

Statistically, it is thought that most of the financial instruments that gap at the opening often move back towards the previous levels before trading resumes in the usual mode. You can seldom come across the trend in classical technical analysis, as it was discovered as early as in the 1990s, and is hardly remembered nowadays. So, in the present interpretation, the formation is rather a proprietary scheme, and I have figured out and repeatedly tested all the orders’ levels myself.

Which chart pattern is best in Forex?

Engulfing Pattern

While there are many candlestick patterns, there is one which is particularly useful in forex trading. An engulfing pattern is an excellent trading opportunity because it can be easily spotted and the price action indicates a strong and immediate change in direction.